Sustainability-linked bond market to swell up to $150 billion: JPMorgan ESG DCM head

Source: Reuters (article link at bottom)

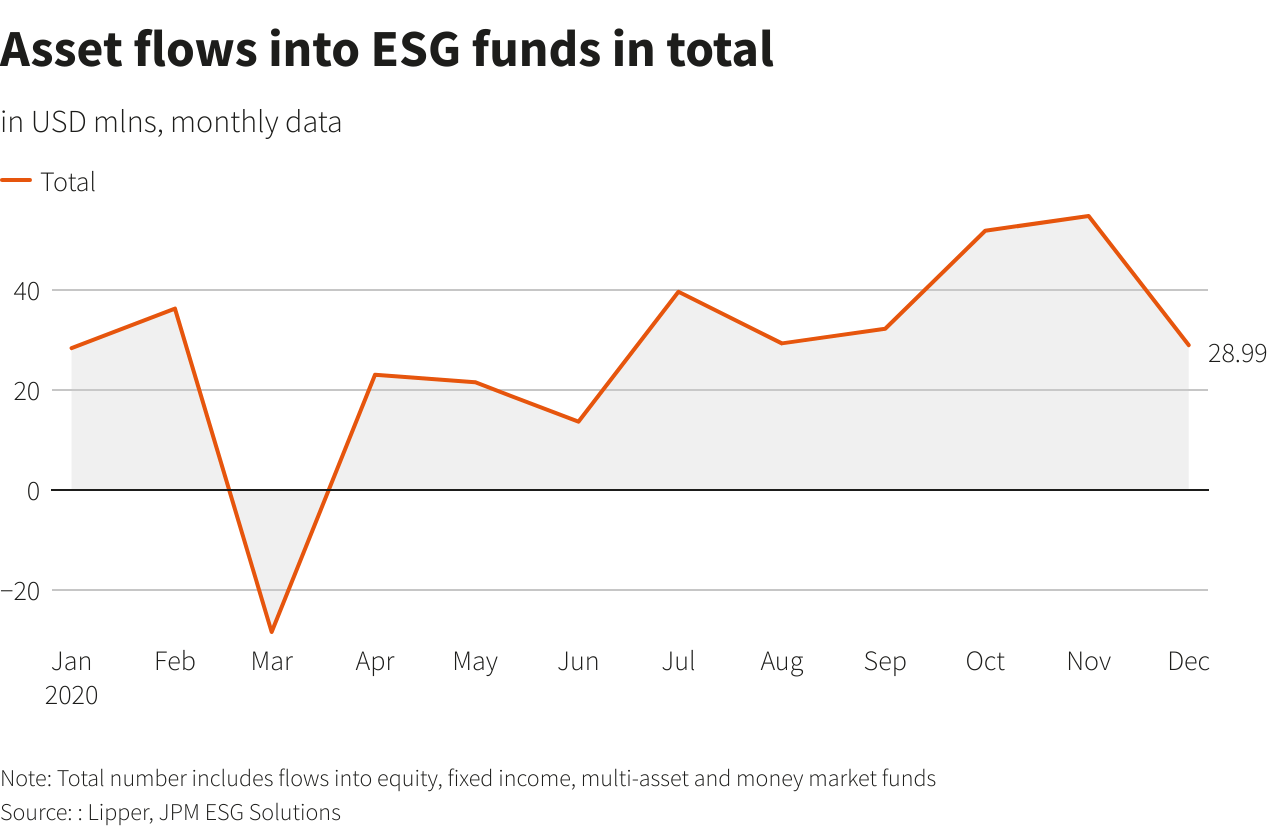

The continual growth in investor interest to seek out companies that prioritize ESG-targets has expanded the channels in which companies with environmental goals may raise capital.

Most are familiar with the utilization of green bonds, which the Climate Bonds Initiative projects to reach, “$400-$450 billion [issuance] this year from almost $270 billion in 2020,” (Climate Bonds Initiative). This fixed-income instrument has supported the funding of climate and environmental projects since The World Bank’s first issuance in 2009 and has grown each year since, alongside tax incentives and increased social awareness.

Despite the fact that green bonds are asset-linked with specific projects, there are few repercussions for issuers if they fail to meet their sustainable project goals.

If investors were solely interested in their return from their bond financing, then they would be investing in the general bond market rather than in green bonds. There are values and direct intentions that lay behind their financing decisions.

Sustainability-Linked Bonds (SLBs), “allow firms to raise money for general corporate purposes while promising investors that if they do not meet the sustainability targets set- such as cutting carbon emissions- they will pay investors extra,” (Ranasinghe, 2021).

SLBs acknowledge the personal values that investors have in ESG-criteria and meeting impactful goals, thus taking a holistic approach alongside the risk of negative financial externalities for issuers as an increased incentive.

The first sustainability-linked bond was issued in 2019 by Italy’s Enel for $1.5 billion, and this past September the Brazilian pulp and paper producer Suzano’s, “sold $750 million carbon emissions-linked bonds,” (Ranasinghe, 2021). The SLB issuance since 2019 is about $20 billion, and according to a senior JP Morgan banker, the market is expected to grow around $120-$150 billion this year.

There has been increased investor interest and engagement in ESG investing in the United States into everyday investment policies but has been widely adopted in the European leveraged loan market.

Author’s Take

The financing of energy technology and projects that aim to improve environmental conditions has gained both the interest and available channels for private investors to take the lead from governments who have been unable to meet their financial needs timeline.

Between ESG investing, impact investing, sustainably responsible investing, SLBs, and the rest of the available financing paths, investors have the choice to fund their own, or their clients’ own, personal values and directly contribute to the outcome of environmental and socially responsible projects. I believe the adoption of SLBs will provide issuers with a rigorous list of expected outcomes and eliminate any room for static movement to ensure real progress.